Last week we revealed how much money the bottom five teams in the Formula 1 constructors’ championship spent on their seasons.

But what did you have to spend to win a race – or a championship – in 2019? @DieterRencken analyses what the top teams spent.

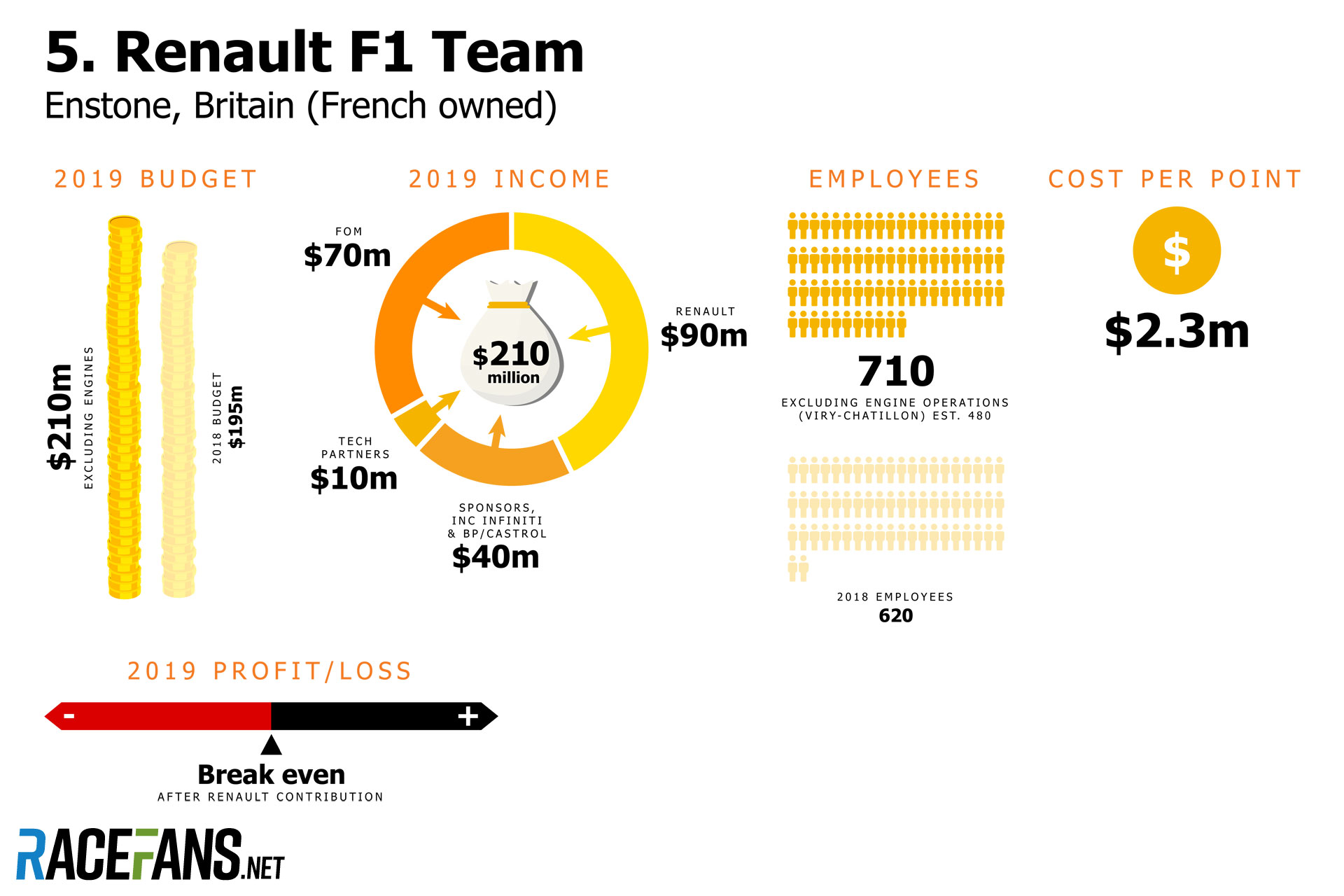

Renault

Despite a solid boost in budget, derived mainly from improved performance income and increased contributions from the parent company, Renault F1 again suffered defeat at the hands of an engine customer. McLaren relegated its supplier to fifth place, suggesting all is not well at the factory team. Indeed, as 2019 drew to a close, Renault confirmed the appointment of Pat Fry (ex-McLaren) as technical director.

Funding is derived from three sources: primarily the Renault parent company, which subsidises group motorsport activities to the tune of $200m per annum across all categories, half of which is allocated to F1. Then there is FOM income – up $10m due to its improved 2018 performance, and thus paid out this year – and commercial funding, mainly BP and Castrol, plus sister brand Infiniti, although the team has secondary sponsors too.

Depending upon measure, the Renault-Nissan-Mitsubishi alliance ranks between first and third in the pantheon of motor manufacturers – and its F1 team should thus perform at the sharp end of the grid. Yet in this most visible of marketing platforms treads water as it awaits clarity from above, where extended chaos reigns after a number of boardroom skirmishes.

Operating separately from the F1 team is the engine division in Viry-Chatillon outside Paris, which designs, develops and distributes power units, but sub-contracts all component manufacture. Thus, this operation is substantially smaller than those of Mercedes and Ferrari.

The team says

We will remain in Formula 1 provided it continues to make sense for the business, for Renault, from a marketing, from a strategy perspective. Right now the indications are pointing in the right direction because it’s pointing towards an improvement of the business case and the value proposition of Formula 1.

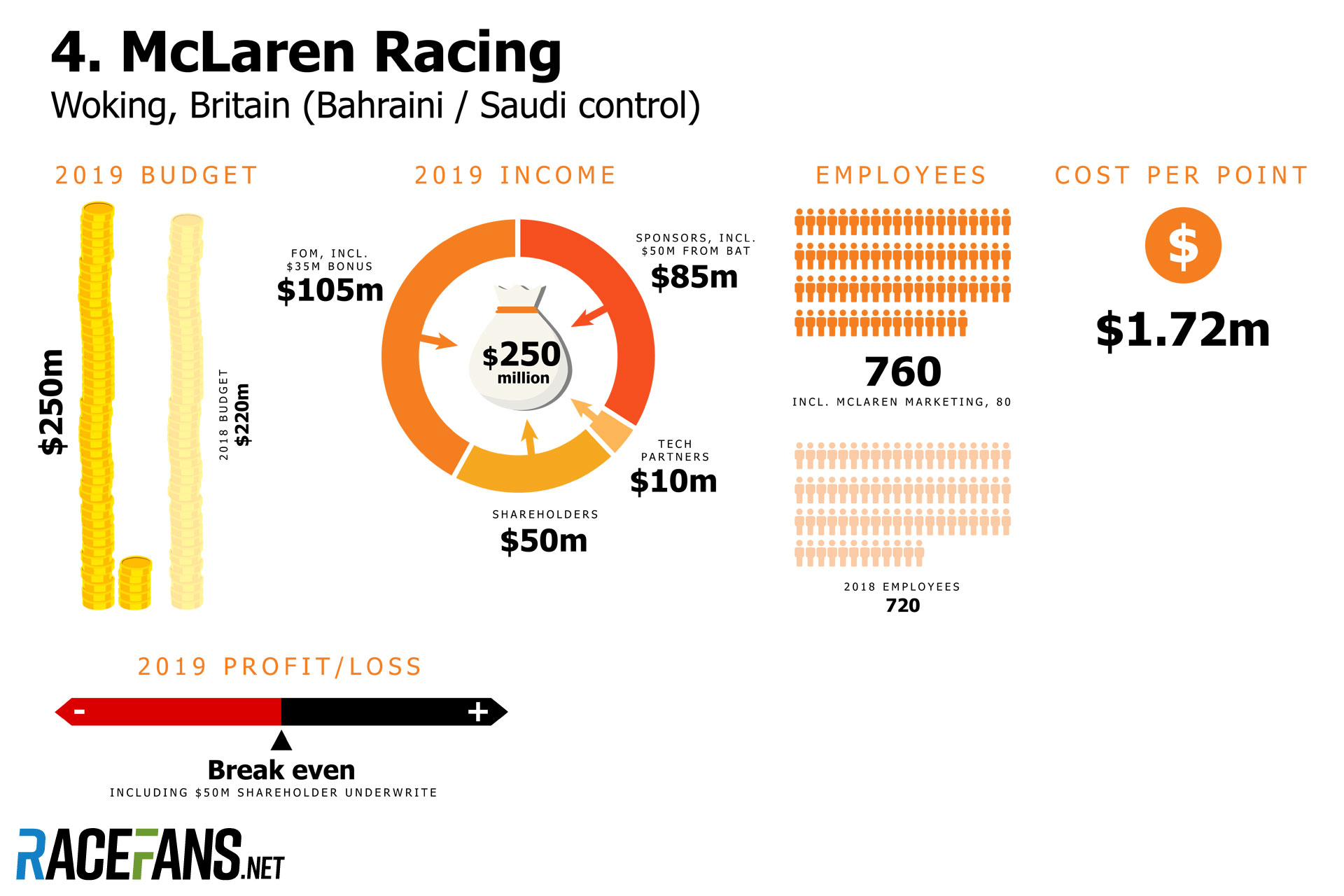

McLaren

From sixth to fourth: in simple terms the change in championship position does not do justice to the season-on-season improvement made by McLaren. They hide quantum leaps in commercial performance with, for example, British American Tobacco choosing to make a (controversial) return to F1 – via its ‘alternate’ products brands – with the team, with a number of other brands also adorning the team’s papaya and blue cars.

The investment required to restore McLaren to its former competitiveness means the team continues to rely upon support from its main shareholder entities. These are Mumtalakat, the Bahraini sovereign wealth fund, and the Ojjeh family from Saudi Arabia. Indeed, shareholder support amounted to 20% of the overall $250m budget. And without that $35m FOM bonus they would have needed to dig a lot deeper.

Still, the shareholders are clearly ambitious. Having welcomed Andreas Seidl as team principal and James Key (technical director) earlier in the year, they immediately tasked them with drawing up a wish list of facilities. A new wind tunnel and driver-in-loop simulator are on order, with other upgrade programmes already underway – timed to anticipate 2021’s limitations on capital expenditure.

All this is a far cry from the doom and gloom of 2017, when the team was classified ninth, when some feared it faced elimination. It had been that close just a few years ago.

The team says

We hit our numbers this year on our sponsor projections. We anticipate hitting them again next year. The car is gradually filling up, some great companies, but definitely we’ll have some great partners for next year, and everyone we have is staying.

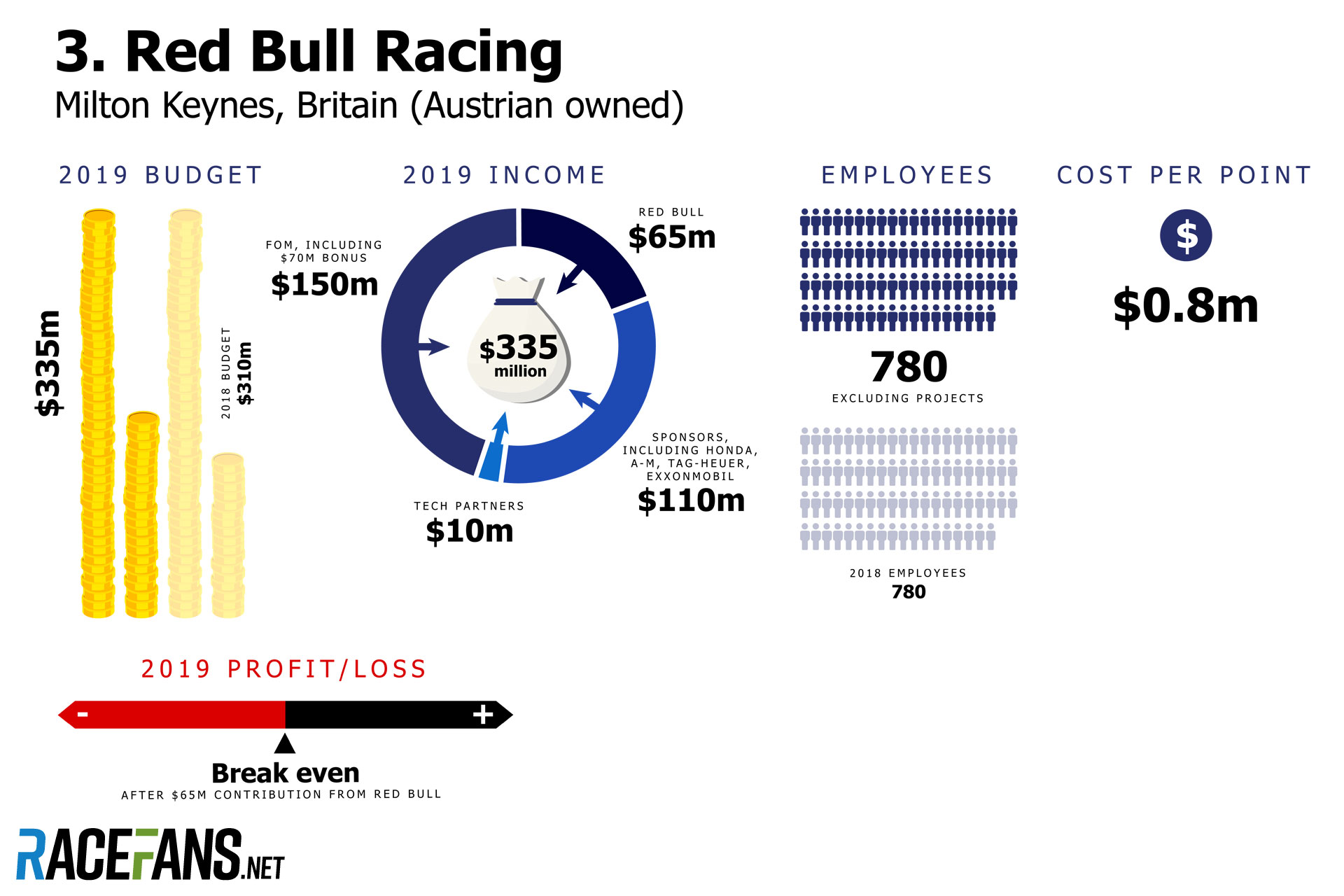

Red Bull

For three years on the bounce Red Bull Racing has been classified third, meaning FOM performance income and bonuses remain stable at $150m total. So have Red Bull’s marketing contributions ($65m). Budgets boosts came mainly from Honda, which from 2019 supplied ‘works’ engines to both Red Bull teams and provides commercial support, and savings on customer Renault units.

The switch to Honda saved the team around $25m per annum, with Honda support amounting to a total of $50m in cash and kind – providing a budget ‘swing’ of $75m – which ultimately explains Red Bull’s ability to run Mercedes and Ferrari close despite an overall budget of some $100m less. True, Honda improved enormously, but the RB15 was believed by many to be the sweetest chassis on the grid – winning three races on merit.

Aston Martin, TAG Heuer and Exxon Mobil provided supplementary funding, with big names such as IBM and AT&T also lending support. But title sponsor Aston Martin’s future involvement remains doubtful. The company is under pressure and could soon change hands – Racing Point owner Lawrence Stroll is a potential suitor – which could put this relationship at risk beyond the 2020 F1 season.

Intercompany synergies mean all Red Bull’s F1 entities are well-placed to benefit from F1’s 2021 financial regulations, which encourage component sharing, although question marks hang over the continued enthusiasm for F1 of Red Bull owner Dietrich Mateschitz, and Honda’s commitment: The Japanese company, in the throes of electric vehicle development, extended its partnership by a single season to the end of 2021.

The team says

It’s been a tough year with the calendar that’s been [long], but it’s also been a productive year, embracing a new technical partner in Honda which has laid the foundation for a solid future. We’ve seen a [budget] increase dictated by the regulation changes and the inflationary costs that go with it.

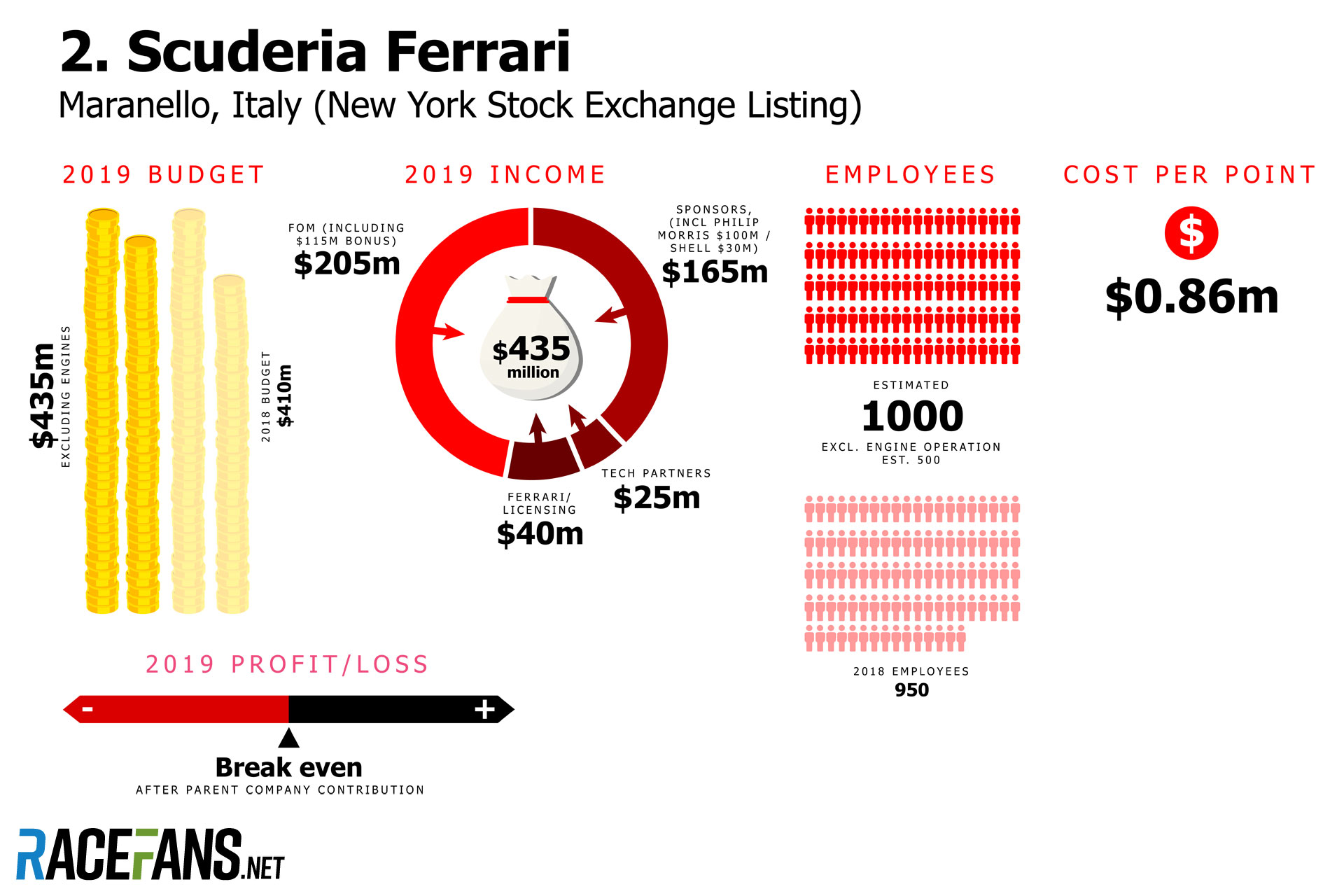

Ferrari

Ferrari uniquely produces its F1 cars and kit within one complex, sharing R&D and manufacturing facilities with the road car division, which supports Gestione Sportiva in lieu of marketing. This business model complicates our reporting as separate financials are not available, with cross-over between departments further fudging the numbers. Thus it will be fascinating to analyse their numbers once the budget cap comes into force for the 2021 F1 season.

Ferrari pockets the largest slice of F1’s revenues, pocketing 20% of F1’s prize pot despite not having won a title since 2008. Shell, UPS and a raft of other brands complementing the $100m provided by Philip Morris International in exchange for carrying its ‘Mission Winnow’ messages (at some races) and providing access to team and image for promotional purposes. Ferrari tops up F1’s joint-largest budget.

But there is push-back, particularly in the USA, against ‘alternate’ tobacco products. That PMI contribution, effectively a quarter of the budget, could eventually be at risk.

Ferrari’s financial fortunes are reflected in its share price (RACE, NYSE), which almost doubled from $98 last January to a September peak of $170, boding well for the future. Although there were concerns about Ferrari’s continued participation in F1 once the budget cap arrived, Ferrari voted in favour of the full regulatory package at FIA World Motorsport Council level.

That said, 2021’s regulatory package is likely to affect Ferrari FOM income, with its Long Standing Team bonuses reduced substantially. Equally, Ferrari carries F1’s largest infrastructure and payroll – albeit partially offset-able within the wider company – so will feel the biggest pinch. However, it is likely to ramp up facilities massively in order to boost productivity, and thus 2020 is likely to be Ferrari’s most expensive yet.

The team says

We do not comment on our financial situation.

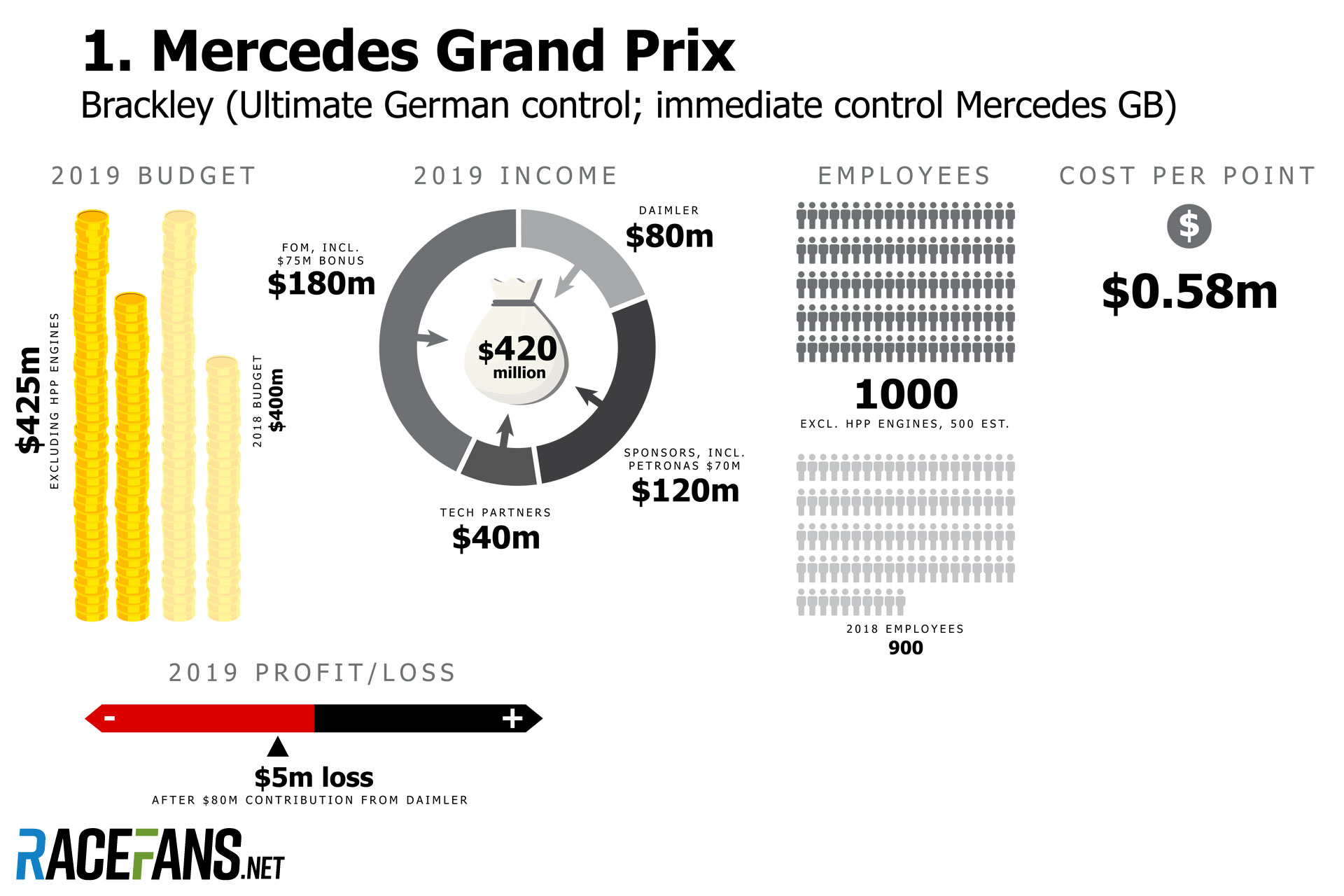

Mercedes

Daimler-Benz’s F1 activities are split into two: Mercedes Grand Prix (race operations) based in Brackley, and High-Performance Powertrains, situated in Brixworth and operating independently to the degree that a single director is common to both operations. The latter supplies the main team, plus engine customers Racing Point and Williams.

RaceFans understands that the shareholdings of Wolff and Lauda revert to Daimler at the end of 2020, with a complex formula based on exposure, capital investment and operating costs determining their value. Then the entire cycle could start again – without Lauda, of course – depending upon the company’s sentiments towards F1. Or otherwise.

Crucial to this decision is Sten Ola Källenius, who was appointed chairman of the board of management of Daimler in May this year after the retirement of Dieter Zetsche, who was the prime mover behind the F1 team. Previously head of HPP, Källenius is now known to favour electrification, so will study return on investment.

Petronas continues as title partner and the team boasts an impressive roster of sponsors to supplement FOM revenues. As serial champions, Mercedes receives the largest cut of FOM’s pre-bonus revenues, but trails Ferrari on overall payout. Daimler contributions increased marginally year-on-year in line with the headcount increase and, crucially, facilities investments ahead of 2021’s belt-tightening.

All this points to a team operating at the very top of its game, and therein lies the biggest challenge: to carry this momentum to a seventh set of double titles while reducing the need for Daimler’s contributions, which would in turn secure its future.

The team says

F1 represents one of the best returns on investments within the whole Daimler group [but] we need to become more efficient. We need to reduce the contribution from Daimler, and if we’re able to achieve that, then we’re in Formula 1 for the long term.

Conclusion

Formula 1 is heading into its final season under the remnants of regulations, processes, procedures and structures imposed by its former owners CVC Capital Partners – who sold out to Liberty Media after inflicting lasting damage on the sport. It does so off the back of a solid 2019, one during which all major metrics headed in the right direction despite increasing competition from that pesky upstart, Formula E.

“Clearly a massive performance gap exists between the ‘Big Three’ – Mercedes, Ferrari and Red Bull – and the rest,” we concluded after crunching these numbers 12 months ago. “No team outside of this trio has won a grand prix in the 100 races since FOM began making inequitable team payments. This is reflected in the size of their budgets.”

These sentiments still prevail, save the number of wins by said teams increased to 121 – further underscoring this point – while budgets at the sharp end got even bigger. Yet, encouragingly, Toro Rosso and McLaren gatecrashed the podium three times between them. While chaotic conditions contributed to their performances, the fact is both teams are on the up.

Mercedes cannot be blamed for again dominating the season – if anything, Ferrari is guilty of serially dropping the ball. Yet such predictability does the F1 brand no favours: not a single one-two victory features strongly in the race ratings by RaceFans readers, while events such as Germany and Brazil, in which the Silver Arrows bombed spectacularly, received massive thumbs-up. Telling, that.

In 2019 F1 teams gained numerous sponsors – BAT controversially led the way and Rokit added colour – while others renewed their commitments. Alfa Romeo saw fit to return, and Honda extended its partnership with the Red Bulls, albeit only for another year. The less said about Rich Energy the better, although the brand’s brief dabble in this piranha tank certainly added short-lived colour.

During the year Liberty and the FIA withstood pressure from F1’s two biggest teams to minimise change ahead of 2021, so much so that both operations gave the eventual package their thumbs-ups, which bodes well for F1’s future. This most political of sports needs strong, unequivocal leadership to thrive, and the relationship between commercial rights holder and regulator seems more united than at any time this decade.

In the final analysis F1 is not yet in rude health, but no longer needs intensive care. That Liberty achieved this turnaround in three short year attests to its solid leadership and the forward vision of its management. Any wonder the FWONK share price sustained record levels in 2019?

The Bang-for-Buck index

On that basis most midfield teams have around $50m per annum discretionary spend for development; the top two, namely Mercedes and Ferrari, over $300m. Yet they found just 0,22 seconds apiece over 2018 at a cost of almost $2bn dollars/second, while McLaren – with its $150m development spend – improved by 1.35 seconds, costing the papaya team $185/second, or a tenth that of Mercedes.

Still, F1’s ultimate yardstick is points scored, and thus team efficiency is measured in performance per dollar terms, or Bang for Buck. In our B4B Index (below) the clear winner is Mercedes despite its $250m budget advantage over independents. This is primarily due to the weighting of points in favour of wins, but a salient point is that the top four B4B teams also receive bonuses of some type. That said, so does Williams.

By whatever measure, Mercedes did the business, so hats off to the team.

| Team | Points | Budget ($m) | Bang for Buck ($m/point) |

|---|---|---|---|

| Mercedes | 739 | 425 | 0.58 |

| Red Bull | 417 | 335 | 0.8 |

| Ferrari | 504 | 435 | 0.86 |

| McLaren | 145 | 250 | 1.72 |

| Toro Rosso | 85 | 155 | 1.82 |

| Racing Point | 73 | 155 | 2.12 |

| Renault | 91 | 210 | 2.3 |

| Sauber | 57 | 155 | 2.7 |

| Haas | 28 | 150 | 5.35 |

| Williams | 1 | 150 | 150 |

RacingLines

- The year of sprints, ‘the show’ – and rising stock: A political review of the 2021 F1 season

- The problems of perception the FIA must address after the Abu Dhabi row

- Why the budget cap could be F1’s next battleground between Mercedes and Red Bull

- Todt defied expectations as president – now he plans to “disappear” from FIA

- Sir Frank Williams: A personal appreciation of a true racer

elchinero (@elchinero)

2nd January 2020, 13:12

Well-done presentation and analysis.

ColdFly (@)

2nd January 2020, 13:21

Another great article, @dieterrencken.

The only suggestion I have is that I’d prefer to see the loss/profit before ‘shareholder contribution’ and the like.

It requires a bit of creative analysis as you will have to split shareholder contribution between sponsorship (e.g. Red Bull plastered on the rear wing or name of the owner’s brand in the team name) and the rest (loss coverage).

drmouse (@drmouse)

2nd January 2020, 13:23

Very interesting.

I don’t think $/point is the best way to evaluate this, though. Given the scale involved, someone finishing near the top will obviously have a lower $/pt even with a massive extra budget, because a huge number of extra points are available at the top of the table, and none at the bottom (bellow the top 10). It is immensely skewed: This is desirable for the championship, as it gives teams & drivers more incentive to challenge for higher positions, but it’s not desirable in analysing the “bang for buck” of a team.

A potentially better scale would be something like “positions from bottom” per point (i.e. someone finishing last would score zero, someone finishing first would score 19). This gives a much more even scale, and accounts for their position finishes outside the top 10.

drmouse (@drmouse)

2nd January 2020, 13:24

“positions from bottom” per DOLLAR, not point…

Dieter Rencken (@dieterrencken)

2nd January 2020, 13:40

Over the years I’ve tried permutations and keep coming back to dollars/point – even when Red Bull or Mercedes won the championship teams such as Force India, Williams and Haas came out tops (or close to) when they punched above their weight.

jamt

2nd January 2020, 14:49

I guess I would try to do something like “Relative Budget” (Team Budget / Minor Budget) v/s points as the quantity USD/point is clearly correlated with how much money a team spends, so actually it do not indicates some kind of efficiency as, I guess, you are trying to show.

Scottie (@scottie)

2nd January 2020, 21:08

I like it also, and it will be interesting how it goes once the budget cap is in place!

Oconomo

2nd January 2020, 14:04

“True, Honda improved enormously, but the RB15 was believed by many to be the sweetest chassis on the grid – winning three races on merit.”

I’m curious who those many are, because last I checked, the general consensus in the paddock was that the RB15, especially in the first half of the season, was everything but sweet and that it took them till Austria to make it easier to drive and even throughout the rest of the season the Mercedes was kinder on its tires.

(Mercedes won 15 races on merit, with an engine believed by many to be basically on par with the Honda after Spa, and below the Ferrari; in my book that gives them the sweetest chassis on the grid.)

Winger

2nd January 2020, 15:52

Mercedes had a better chassis for sure especially in the first half. Bottas was 0.444 faster on Verstappen in S3 Spain qualy where was Mercedes was by far in their own league. That is where the entire magic diff discussion came about. Also at one point Mercedes was faster in all corner types compared to RB who had the 2nd best chassis on the grid.

Revit

2nd January 2020, 22:37

Mercedes have hydraulic suspension which Ferrari didn’t have and red bull less complicated version to me this was banned in 1994 and then again aka Renault Alonso era

anon

3rd January 2020, 18:04

Revit, I think you have misunderstood what exactly was banned in 1994 – what was banned in 1994 was active suspension, where the response of the suspension is actively controlled by an onboard system that acts to apply a force to the suspension components.

What the teams then started using was an interlinked suspension system – basically, they would link the hydraulic circuits of the front and rear suspension systems. That is an entirely passive system, and it’s actually a fairly old idea – Minardi had a similar system in 1993 on the M193, and Tyrrell developed a more advanced system, which they called “Hydrolink”, in 1995, although it proved to be difficult to tune and they eventually removed it from the 023. McLaren also used that system on the MP4/12C road car, and its successors, as it gives a number of benefits associated with active suspension but with less complexity and cost.

The FIA did then start restricting that in 2014, before 2015 saw them effectively ban it – the thing is, whilst some saw it as a move aimed at handicapping Mercedes, it looks like, although it did hurt them a bit, it hurt some other teams to a far greater extent.

Some have noted that the restrictions in 2014 probably actually hurt the Lotus-Renault team the most, as they were rumoured to have had the best system – it being part of the reason for their cars having good tyre management characteristics in 2012 and 2013 – whilst further changes to the regulations in 2015 were thought to be a contributing factor towards Red Bull’s relatively poor 2015 season.

When people talk about Mercedes and Red Bull using a “hydraulic” system, it’s different to those systems again – in their case, they have replaced the heave spring with a hydraulically operated element instead. Those systems were challenged by Ferrari in 2017, but the system Mercedes used was declared legal – though it’s a little harder to tell whether the system Red Bull used, which was reportedly more complex and a lot more extensive, was also declared fully legal.

Sensord4notbeingafanboi (@peartree)

2nd January 2020, 15:05

These perfect numbers. They fit my narrative perfectly. Nobody could have guesstimate this. So many surprises. This is better than the panama leaks and Snowden’s.

Jere (@jerejj)

2nd January 2020, 15:46

I wonder what’s different regarding talking about the financial situation concerning Ferrari versus the rest of the teams? The others didn’t go into massive detail about it anyway, so why Ferrari not at all then?

Lenny (@leonardodicappucino)

2nd January 2020, 17:36

I’d love to see the dollars per second index in full, seeing how the Bang 4 Buck index only shows that Ferrari and Renault are being inefficient, the rest just being in Championship order.

David

2nd January 2020, 19:07

Yet another statistic showing how lost Williams is nowadays.. I believe in 2014 they came out in top (dollar spent/point) with a driver line up of a way past his prime Massa and a much less expierienced Bottas!

Mog

2nd January 2020, 21:51

Makes you wonder why they havnt replaced their acting team principal yet.

Stephen Crowsen (@drycrust)

3rd January 2020, 18:17

Yes, Williams are going to have to produce some good results this season. I guess the surprise is more heads didn’t roll as a consequence of their turning up late for the pre-season testing and the poorly performing car. If there’s a repeat then the shareholders are going to have to demand changes.

anon

3rd January 2020, 8:08

David, amazing how people only remember the few years of fluke results and forget the near decade of poor to indifferent results before that…

Let’s be frank, if Williams were top in 2014, that would be something of a freak result when compared to years before or after – which tells you that it’s not really anything to do with how good they were that season, just that they were relatively lucky that so many other teams made even bigger mistakes.

David

3rd January 2020, 13:57

@anon

I’m aware they are pretty much downhill since BMW left them and know 2014 was an outlier thanks to the superior Mercedes engine at dawn of the current power unit system, but even if you compared them to their recent hystory threy are really underwhelming the past 3 years.

It just makes me sad and I’m a fan of the brand, that’s all

anon

4th January 2020, 10:22

I don’t know – some of their previous seasons were perhaps flattered by the presence of other weak teams, such as 2011 and 2013: they could at least guarantee beating the Caterham-Manor-HRT grouping, but little else.

charliex (@photogcw)

3rd January 2020, 15:46

I and a few of my American F1 fan friends are wondering how much longer will Gene Haas bankroll the team out of his own money. They can’t get or keep a title sponsor for a whole season. My guess is 2021 as the deadline: Gene either folds the team or sells it cheaply.

Rob Giacometti

4th January 2020, 2:48

Brilliant stuff – great job Dieter. I have been hooked on this sport/ business since 1980 when , here in Australia, we were deemed suitable enough to have Formula 1 on our tv ( only because Alan Jones started winning races and even then , they were “ delayed” telecasts – even though our beloved channel 9 tried to make them appear as “ live”!!), and I absolutely love reading all the behind the scenes machinations and the money stories , sponsor stories , power plays , politics and all of the associated skullduggeries.Cheers.

DennisF1

5th January 2020, 13:31

What I find most interesting about these figures is the increase in number of employees at almost every team. The fact that they keep complaining about costs yet increase them by hireing more people doesnt make sense. Also pretty clear that the Williams operation is too big to be a normal midfield team with too much money going to employees. Would be interesting to see what the teams spend their money on. The result of break even makes sense since parrent companies can basicly use the f1 teams to decrease the taxed profit of their other devisions.

GeeMac (@geemac)

6th January 2020, 14:54

This is the crucial line and is also what is making me less hopeful that the budget cap will have any effect on the competitive order. The fact is this: The teams that spend more now can invest more heavily in their resources now (i.e. pre-budget cap) and will continue to reap the rewards of those investments post 2021, thus embedding the current inequality across the grid. I hope I’m wrong, but I don’t think I am.

Thanks for these articles @dieterrencken, they are fascinating reading.